The content on this page is marketing communication

Value rotation: How to ride the recovery

The second half of 2016 saw value investing come back into fashion after eight years of underperforming growth. We discuss whether a longer term shift in favour of value stocks could be underway.

In this article we consider three topics:

- An appraisal of value and growth investing, and how the two styles have performed over time

- Why changing cyclical economic and market factors look supportive for value investment

- Where to find value and why investors need to be pragmatic to generate the best returns

The second half of 2016 saw value investing – buying stocks which are cheap relative to their fundamentals such as book value, earnings or cash flow – come back into fashion after eight years of underperforming growth. Although growth investing – buying shares in companies with expanding earnings or revenues – has returned to the ascendancy so far in 2017, several key indicators suggest that a longer-term shift in favour of value stocks could be underway.

The roots of value investing can be traced back to Benjamin Graham, who pioneered the use of intrinsic valuation techniques to beat the market and provide downside protection. His book Security Analysis was inspired by the stock market crash of 1929 when many investors, including Graham, suffered huge losses as an overheated US equity market plunged 50% in just over two weeks and lost 90% in less than three years. SKAGEN's approach to value investing, which has remained consistent for nearly a quarter of a century, similarly uses fundamental analysis to find undervalued stocks with identifiable catalysts to trigger a re-pricing to their fair value.

Cyclical supremacy

Growth investors, in contrast, typically buy companies with above-average growth, even if the share price appears expensive relative to metrics such as the price-to-earnings or price-to-book ratio. Given the fundamental differences in the contrasting styles, one inevitably outperforms the other and both approaches have enjoyed historic periods of dominance with cycles often lasting five years or more.

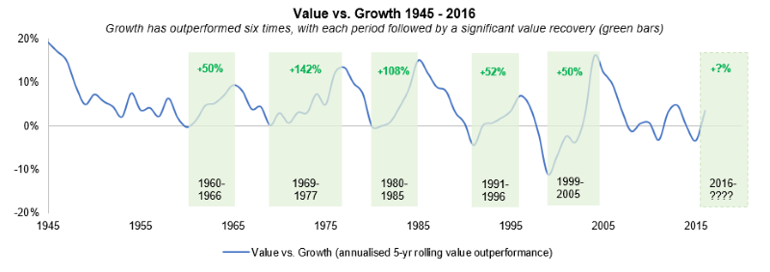

The chart below shows the trailing five-year annualised returns of a hypothetical portfolio that rises when value stocks outperform and falls when growth performs better. It shows that value has outperformed growth across most five-year periods since World War II by around 5% on an annualised basis. There have been six distinct phases when growth has had the upper hand, the latest of which ended after nearly a decade last year, with subsequent periods characterised by very strong value performance over the next five-plus years with returns of between 50% and 142%.

Macro and market tailwinds

There are several factors behind the latest 'big rotation'. With company profits having stagnated or fallen for much of the past few years due to low economic growth, investors have been prepared to pay a premium for growth stocks and unwilling to risk investing in bargains. The IMF recently upgraded its 2017 and 2018 growth forecasts for advanced economies* and if economic expansion drives continued improvements in corporate earnings, value stocks should prosper.

In the US, vital for its contribution to global economic growth and the size of its equity market, President Trump has promised expansionary policies to reflate the economy. Following his election last November, we have already seen most cyclical sectors (typically value stocks) outperform the broader equity market while traditional growth sectors (e.g. technology and healthcare) have underperformed.

Some of the strongest periods of historic value performance have come when equities have retreated following a market correction. In these conditions growth stocks generally suffer as investors seek safety in cheaper companies. With many stock markets currently at record highs, value would appear to be the safest option. According to a recent fund manager survey**, stocks are seen as the most overvalued since the 1990s while Robert Shiller's cyclically adjusted price earnings ratio, traditionally one of the best yardsticks for whether shares are over or under-valued, has only twice been higher than its current level; in 1929 ahead of the Wall Street Crash and before the dotcom bubble burst in 2000.

Pockets of value

With stock markets generally looking expensive, value is harder to find but there are several pockets of opportunity where investors could benefit from a sustained rotation towards value stocks. Despite their recent rally, emerging markets remain at a steep discount to developed markets; 30% cheaper on a forward P/E and 35% lower on a P/B basis***.

Turkey (forward P/E 8.3x) and Brazil (forward P/E 11.6x) are examples of countries where political challenges have created opportunities and where SKAGEN Kon-Tiki is currently overweight. Its Turkish holdings – currently 7.7% of the fund – are all well run companies with improving operations and solid balance sheets while the Brazilian stocks – currently 7.2% of the portfolio – are leading companies with attractive valuations which made up three of the fund's top five contributors in 2016.

A further example is Europe, where the economic outlook is poor and growth is expected to remain sluggish. SKAGEN Global is currently overweight European stocks – 28% of the fund is invested there compared to 19% for its benchmark – having invested in strong companies across different countries, many of which operate globally, at compelling valuations.

The key for value investors is to correctly identify mispriced stocks and the catalysts that will unlock their intrinsic worth, thereby delivering share price gains and avoiding value traps. To be successful, it is important to look globally for the best investment cases and it also pays to be pragmatic. The price-to-book ratio, for example, is an important value screening tool which is particularly useful in sectors with significant tangible assets, such as energy, telecoms and utilities. In 2010, these sectors made up 28% of the global equity market, compared to just 19% today and in future even greater value is likely to be created by 'asset-lite' companies from the technology and healthcare sectors, which together make up 27% of the current equity market, up from just 20% in 2010.

This implies that the P/B ratio is increasingly inappropriate for screening value stocks and appraising a company's fundamental worth on a standalone basis. For example, several of our funds' top holdings currently trade at a price-to-book of over four times and could therefore be considered 'rich' or 'growth' stocks. Most other metrics, however, recognise the same companies as 'value' stocks, which illustrates the need for investors to apply a practical and multi-faceted approach to valuation.

In summary, while value investing has been out of favour until recently, several significant cyclical factors suggest that better times may be ahead while its structural advantages of providing upside potential and downside protection remain unchanged. For investors, the best risk-adjusted returns are likely to be found by using an active approach within a global mandate to find the best ideas.

Given our successful track-record and that our portfolios are valued significantly below their benchmarks, our funds look well-placed to deliver absolute and relative gains, particularly if the value rotation gathers pace.

* IMF World Economic Outlook Update, January 2017

** BofA Merrill Lynch Fund Manager Survey, March 2017

*** MSCI Emerging Markets Index, MSCI World Index as at 31 March 2017